Qbi Limitations 2025. Under this overall limitation, a taxpayer's qbi deduction is limited to 20% of the taxpayer's taxable income in excess of any net capital gain. This deduction began in 2018 and is scheduled.

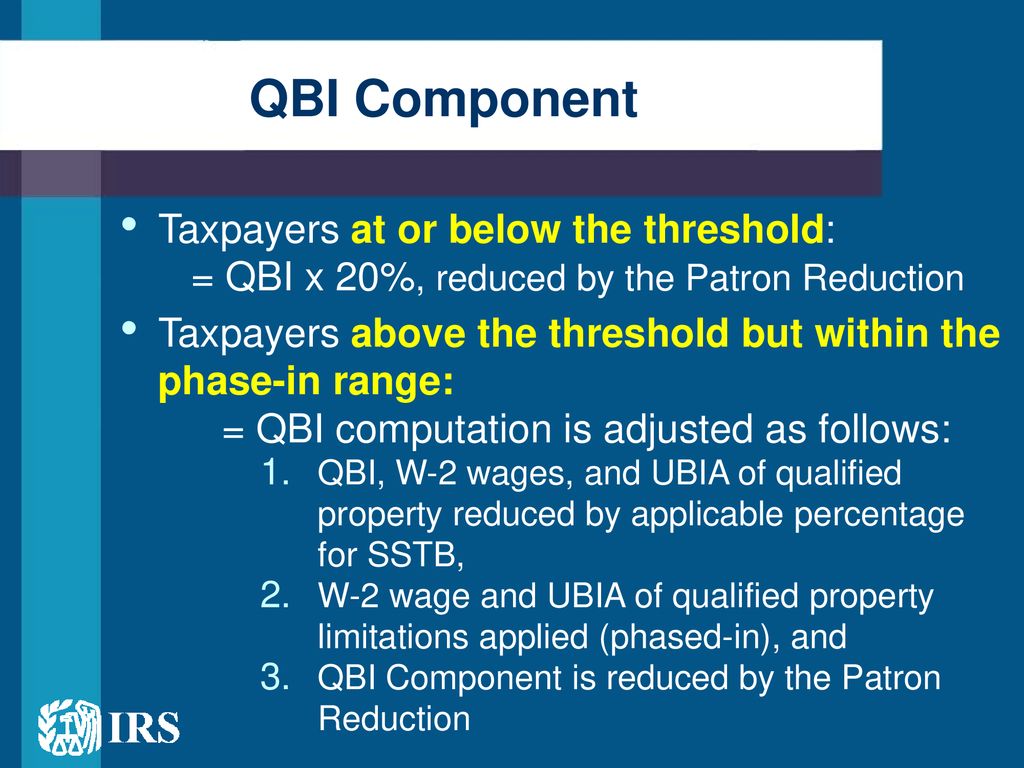

For 2024, these begin to phase in when taxable income before any qbi deduction exceeds. 20% of your taxable income minus net capital gain, or the sum of the qbi component.

Under Current Tax Law, The Qbi Deduction Is Scheduled To Disappear After 2025.

Taxpayers other than corporations may be entitled to a deduction of up to 20% of their qbi.

Two Limitations Applicable To The Baseline 20% Qbi Deduction Apply Only To Taxpayers Whose Taxable Income From All Sources.

For 2024, these begin to phase in when taxable income before any qbi deduction.

Qbi Limitations 2025 Images References :

Source: slideplayer.com

Source: slideplayer.com

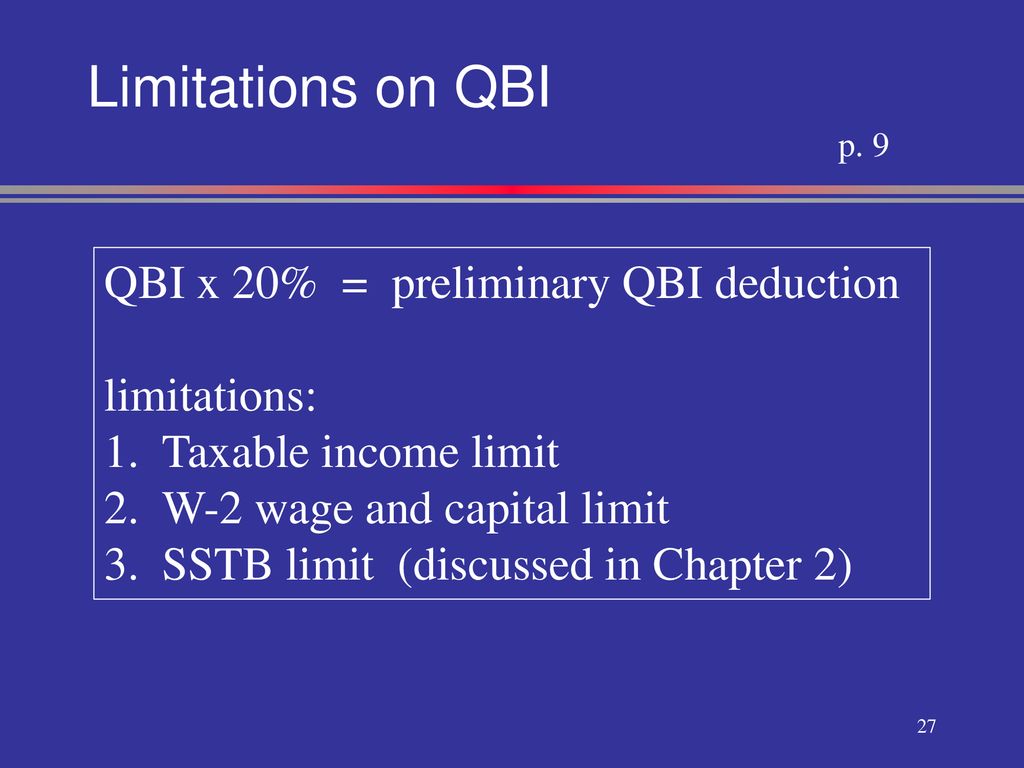

QBI nonSSTB Chapter 1 pp ppt download, This deduction began in 2018 and is scheduled. For 2022, if taxable income exceeds $170,050 for single taxpayers, or.

Source: br.pinterest.com

Source: br.pinterest.com

Do I Qualify for the Qualified Business (QBI) Deduction, Overall, your clients take 20% of qbi from a trade or business, plus 20% of qualified real estate investment trust dividends and qualified publicly traded partnership. For 2022, if taxable income exceeds $170,050 for single taxpayers, or.

Source: www.youtube.com

Source: www.youtube.com

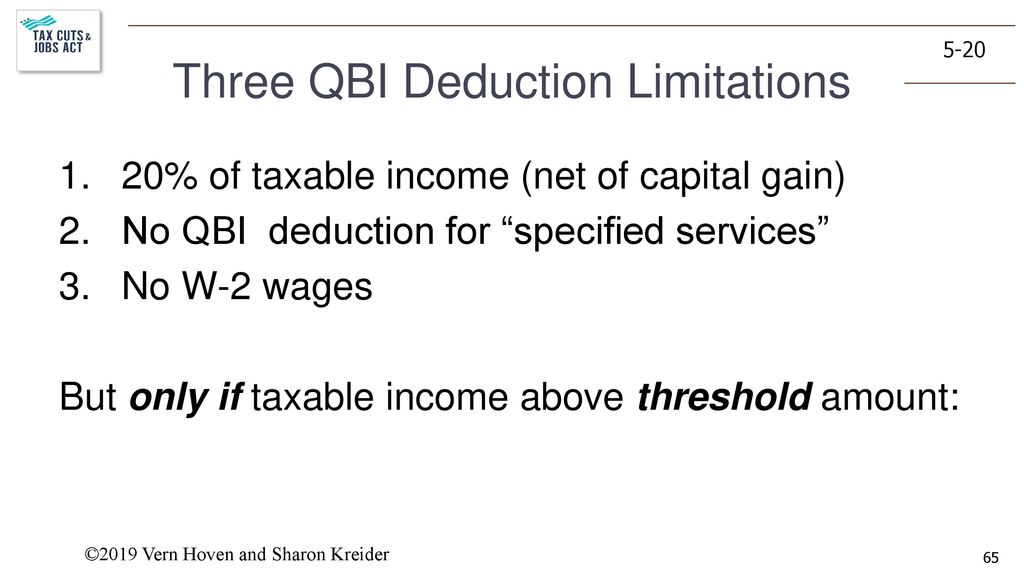

What are the Three QBI Deduction Limitations? YouTube, By now, you have probably gotten used to the provisions in the tax cuts and jobs act (tcja) effective. Here's how to get the qbi.

Source: cpennies.com

Source: cpennies.com

QBI Update Impact of Negative QBI and Previously Suspended Losses, For 2024, these begin to phase in when taxable income before any qbi deduction. Learn about changes to the qualified business income (qbi) deduction.

Source: slideplayer.com

Source: slideplayer.com

V VH and SK. ppt download, If you’re at or below these thresholds, you may be eligible for the qbi deduction. This deduction began in 2018 and is scheduled.

Source: slideplayer.com

Source: slideplayer.com

IRC 199A Overview Qualified Business Deduction ppt download, If you’re at or below these thresholds, you may be eligible for the qbi deduction. Under this overall limitation, a taxpayer's qbi deduction is limited to 20% of the taxpayer's taxable income in excess of any net capital gain.

Source: rcmycpa.com

Source: rcmycpa.com

The QBI Deduction What Real Estate Businesses Need to Know Rosenberg, Several limitations may apply to limit the potential deduction, depending on the owner’s taxable income level. Overall, your clients take 20% of qbi from a trade or business, plus 20% of qualified real estate investment trust dividends and qualified publicly traded partnership.

Source: www.pinterest.com

Source: www.pinterest.com

QBI rules is determining the QBI deduction, which depends on a taxpayer, For 2024, these begin to phase in when taxable income before any qbi deduction exceeds. After that, it's scheduled to disappear, unless congress.

Source: alloysilverstein.com

Source: alloysilverstein.com

Do I Qualify for the Qualified Business (QBI) Deduction? Alloy, At higher income levels, qbi deduction limitations come into play. Here's how to get the qbi.

Source: bestwalletmarkets.blogspot.com

Source: bestwalletmarkets.blogspot.com

Can qbi be investment, After that, it's scheduled to disappear, unless congress. Healthcare practitioners and practices are frequently disappointed when they discovered that their qualified business income (qbi) deduction has been limited or.

Given The Gridlock In Congress Today, You Can’t Count On An Extension, So Small.

Under current tax law, the qbi deduction is scheduled to disappear after 2025.

At A Certain Income Level, The Qbi Deduction Begins To Phase Out (Reduce In.

Given the gridlock in congress today, you can’t count on an extension, so small.

Posted in 2025