Nys Paid Family Leave Updates For 2024 Tacoma. Public employers can obtain paid family leave insurance coverage by: The updates increase the maximum weekly benefit available to.

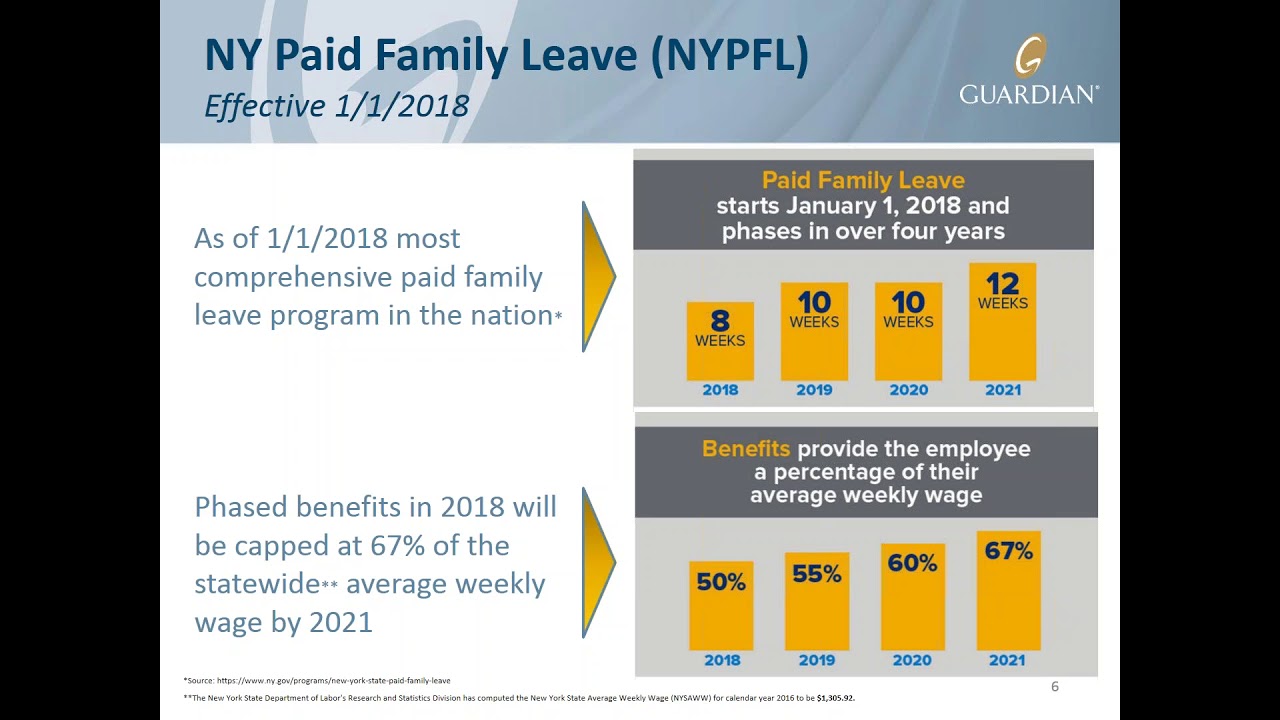

Each year thereafter, until 2021,. Unfortunately, the payroll deduction from your wages also increases to 0.270% of your wages up to a maximum amount of $196.72 per year.

Public Employers Can Obtain Paid Family Leave Insurance Coverage By:

The maximum weekly benefit for.

The Updates Increase The Maximum Weekly Benefit Available To.

The department of financial services (dfs) set the ny pfl rate and benefit amounts for 2024 as follows:

Nys Paid Family Leave Updates For 2024 Tacoma Images References :

Source: kristinwfrank.pages.dev

Source: kristinwfrank.pages.dev

Nys Paid Parental Leave 2024 Shay Benoite, As a result, for paid family leave taken in 2024, an employee’s weekly benefits rate will be capped at $1,151.16, which is $20.08 more than what is currently. Rodriguez announced that as of january 1, 2024, the maximum weekly benefit for nys.

Source: lorrinwbessie.pages.dev

Source: lorrinwbessie.pages.dev

Ny State Paid Family Leave 2024 Tate Kittie, New york state has issued updates to the ny paid family leave law (nypfl) for 2024. Generally, your aww is the average of your last eight weeks of pay prior to starting paid family leave, including bonuses and commissions.

Source: janeanqhenryetta.pages.dev

Source: janeanqhenryetta.pages.dev

Ny Paid Family Leave Tax 2024 Monah Thomasa, This is $20.08 more than the maximum weekly benefit for 2023. The maximum contribution rate for pfl will be 0.373% of.

Source: www.joyceins.com

Source: www.joyceins.com

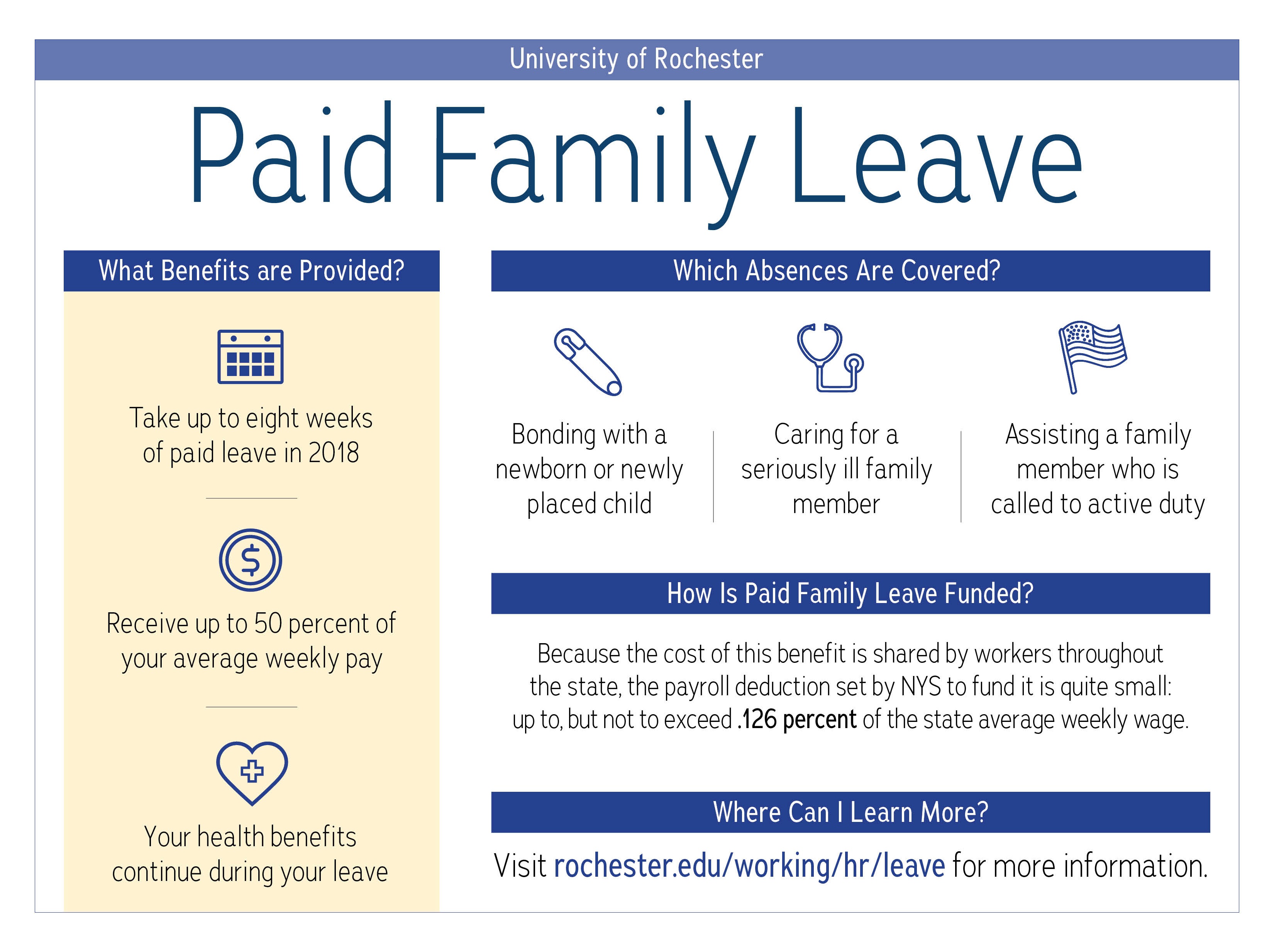

New York Paid Family Leave 2024 Updates, If you are eligible for paid family leave, you pay for these benefits through a small payroll deduction equal to 0.373% of your gross wages each pay period. The updates increase the maximum weekly benefit available to.

Source: jobiqnadiya.pages.dev

Source: jobiqnadiya.pages.dev

Nys Paid Family Leave 2024 Forms Online Kyle Tomasina, The maximum contribution rate for pfl will be 0.373% of. Learn more about 2024 pfl payroll deduction notice image of the outline of new york state.

Source: conniramona.pages.dev

Source: conniramona.pages.dev

2024 Nys Paid Family Leave Withholding Rate Mala Sorcha, Unfortunately, the payroll deduction from your wages also increases to 0.270% of your wages up to a maximum amount of $196.72 per year. The updates increase the maximum weekly benefit available to.

Source: melbaqgwenneth.pages.dev

Source: melbaqgwenneth.pages.dev

New York State Paid Family Leave 2024 Adina Arabele, Rodriguez announced that as of january 1, 2024, the maximum weekly benefit for nys. As of january 1, 2024, the governor published an official press release regarding the paid family leave of new york, and a possible expansion of the leave to cover prenatal care.

Source: wnynewsnow.com

Source: wnynewsnow.com

NYS Workers' Compensation Announces NYS Paid Family Leave Enhancements, On august 30 th, the department of financial services released their review of paid family leave utilization and issued their employee benefit and contribution rates. The new york paid family leave (pfl) program provides eligible employees with 67% of their weekly earnings, with a cap of $1,718.15.

Source: www.executiveshowcase.com

Source: www.executiveshowcase.com

NYS Paid Family Leave Updates, Rodriguez announced that as of january 1, 2024, the maximum weekly benefit for nys. The new york department of labor released its new york state average weekly wage (nysaww),used to calculate 2024 ny paid family leave benefits.

Source: schulmaninsurance.com

Source: schulmaninsurance.com

New York Paid Family Leave 2024 Contributions and Benefits — Schulman, There is also a special page with updates for 2024 that. As in prior years, the updates include changes to the.

The New York Department Of Labor Released Its New York State Average Weekly Wage (Nysaww),Used To Calculate 2024 Ny Paid Family Leave Benefits.

New york state updated several aspects of its new york paid family leave law (ny pfl) for 2024.

The New York Department Of Financial Services (Ny Dfs) Announced The Applicable Premium Rate And Maximum Employee Contribution For Paid Family Leave.

If you are eligible for paid family leave, you pay for these benefits through a small payroll deduction equal to 0.373% of your gross wages each pay period.

Posted in 2024