401k 2024 Contribution Limit Irs Mega Backdoor Roth. How much can you convert to a backdoor roth? How does this add up?

The 401(k) contribution limit for 2024 is $23,000 for employee contributions, and $69,000 for the combined employee and employer contributions. This is the total irs limit minus the 401(k) contribution limit.

How Much Can You Convert To A Backdoor Roth?

How much can you convert with a mega backdoor conversion in 2024?

The Maximum Roth Ira Contribution For 2023 Is $6,500, Plus $1,000 For Employees Ages 50 And Above—Far Less Than The $66,000 ($73,500 If Age 50 Or Older) That A Corporate Employee Can Contribute.

If you’re age 50 or.

Your 401 (K) Contributions Increased In 2024.

Images References :

Source: esmebmicaela.pages.dev

Source: esmebmicaela.pages.dev

2024 Roth Maximum Contribution Gina Phelia, The regular 401(k) contribution for 2024 is. In 2024, the contribution limit is $23,000 if you’re under 50 and.

Source: shaylawemmey.pages.dev

Source: shaylawemmey.pages.dev

2024 Roth 401k Limits Moira Lilllie, How much can you convert to a backdoor roth? If you’re under 50, you can contribute up to $23,000 and if you’re 50 or older you can contribute up to $30,500 ($23,000 plus a.

Source: ardisjqcarissa.pages.dev

Source: ardisjqcarissa.pages.dev

Mega Backdoor Roth Limit 2024 Cris Michal, In 2024, the contribution limit for a roth 401(k) is $23,000, plus an additional contribution of $7,500 if you are age 50 or older. If you’re under 50, you can contribute up to $23,000 and if you’re 50 or older you can contribute up to $30,500 ($23,000 plus a.

Source: earthaqkalinda.pages.dev

Source: earthaqkalinda.pages.dev

Roth 401k Limits 2024 Alicia Kamillah, If you're age 50 or. The maximum employer + employee 401k plan contribution in 2024 is $69,000, or $76,500 if you’re age 50+ with the.

Source: lauriqdarelle.pages.dev

Source: lauriqdarelle.pages.dev

Mega Backdoor Roth 2024 Limit Bessy Charita, The 401(k) contribution limit for 2024 is $23,000 for employee contributions, and $69,000 for the combined employee and employer contributions. The maximum roth ira contribution for 2023 is $6,500, plus $1,000 for employees ages 50 and above—far less than the $66,000 ($73,500 if age 50 or older) that a corporate employee can contribute.

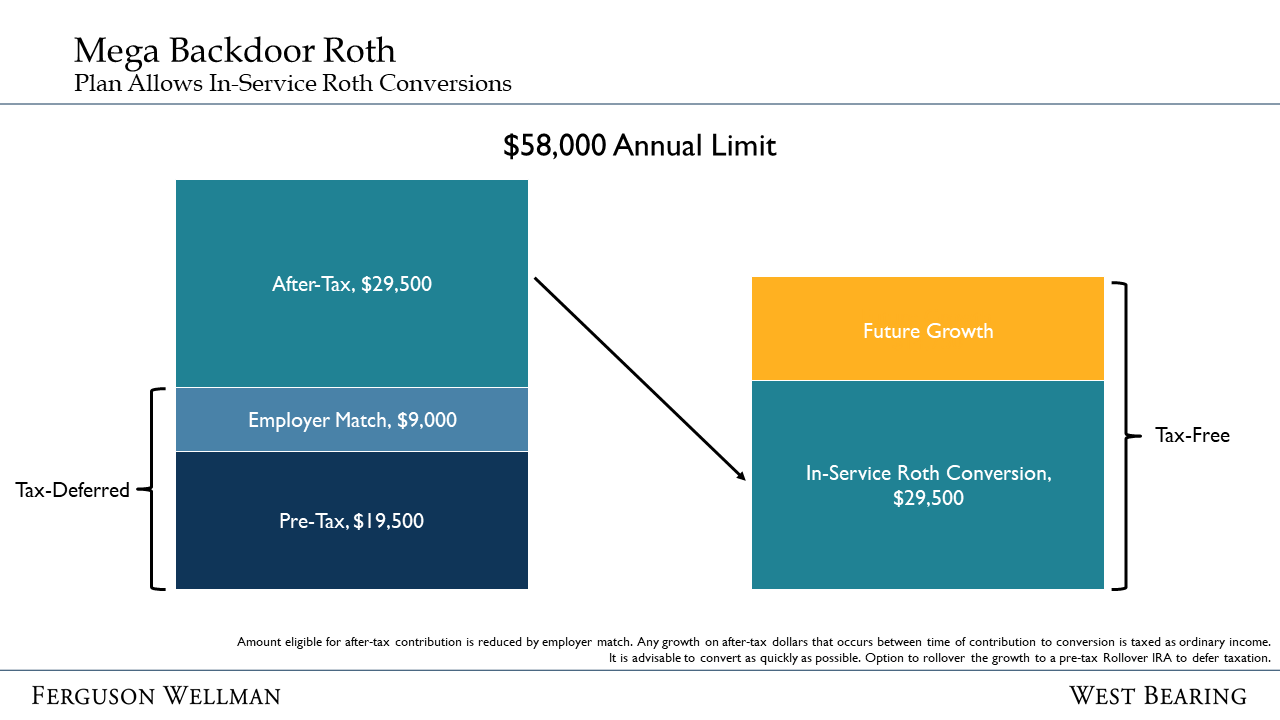

Amazon Mega Backdoor Roth Sophos Wealth Management, The resulting maximum mega backdoor roth ira contribution for 2024 is $46,000, up from $43,500 in 2023 if your employer makes no 401(k) contributions on. If you're age 50 or.

Source: rgwealth.com

Source: rgwealth.com

The Mega Backdoor Roth How Does It Work? RGWM Insights, How does this add up? In 2024, the contribution limit is $23,000 if you’re under 50 and.

Source: seekingalpha.com

Source: seekingalpha.com

Mega Backdoor Roth Definition & How It Works Seeking Alpha, In 2024, the contribution limit for a roth 401(k) is $23,000, plus an additional contribution of $7,500 if you are age 50 or older. Employers can contribute to employee.

Source: jeniqcelestia.pages.dev

Source: jeniqcelestia.pages.dev

2024 Limit For Roth Ira Nance AnneMarie, The regular 401(k) contribution for 2024 is. The maximum roth ira contribution for 2023 is $6,500, plus $1,000 for employees ages 50 and above—far less than the $66,000 ($73,500 if age 50 or older) that a corporate employee can contribute.

Source: www.mysolo401k.net

Source: www.mysolo401k.net

SelfDirected Roth Solo 401k Contribution Limits for 2024 My Solo, In 2024, the contribution limit is $23,000 if you’re under 50 and. Roth 401 (k) contributions are not subject to an income limit.

The Maximum Roth Ira Contribution For 2023 Is $6,500, Plus $1,000 For Employees Ages 50 And Above—Far Less Than The $66,000 ($73,500 If Age 50 Or Older) That A Corporate Employee Can Contribute.

The regular 401(k) contribution for 2024 is.

How Much Can You Convert With A Mega Backdoor Conversion In 2024?

In 2024, the contribution limit for a roth 401(k) is $23,000, plus an additional contribution of $7,500 if you are age 50 or older.